How much borrow mortgage salary

How much can I afford to borrow. These factors are taken into consideration when a mortgage lender calculates how much they could ideally lend you for a mortgage.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

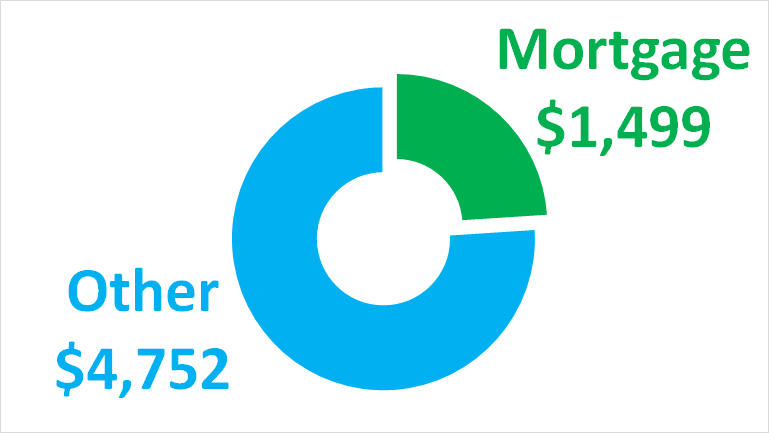

Determining your monthly mortgage payment based on your other debts is a bit more complicated.

. The amount you can borrow for your mortgage depends on a number of factors these include. See the example below. The amount you can borrow for a mortgage depends on many variables and income is just one of them.

4 or 45 times salary was the limit. Calculate how much you can borrow. Your debt-to-income DTI ratio helps you understand how much to spend on a mortgage.

When it comes to calculating affordability your income debts and down payment are primary factors. Find out about payday loans and what are cheaper ways you can get money fast. A payday loan is usually the most expensive way to borrow money.

Your salary bill payments any additional outgoing payments including examples such as student loans or credit card bills. To Whom It May Concern. 31000 23000 subsidized 7000 unsubsidized Independent.

Use our guide to work out how much youll need to pay. His salary is 80000 per annum gross. Why salary deposit affects how big a mortgage you can get.

Use this calculator to determine what your hourly wage equates to when given your annual salary - it may surprise you what you make on an hourly basis. With a payday loan you can borrow up to 2000 quickly but has a lot of high fees. How much can you borrow.

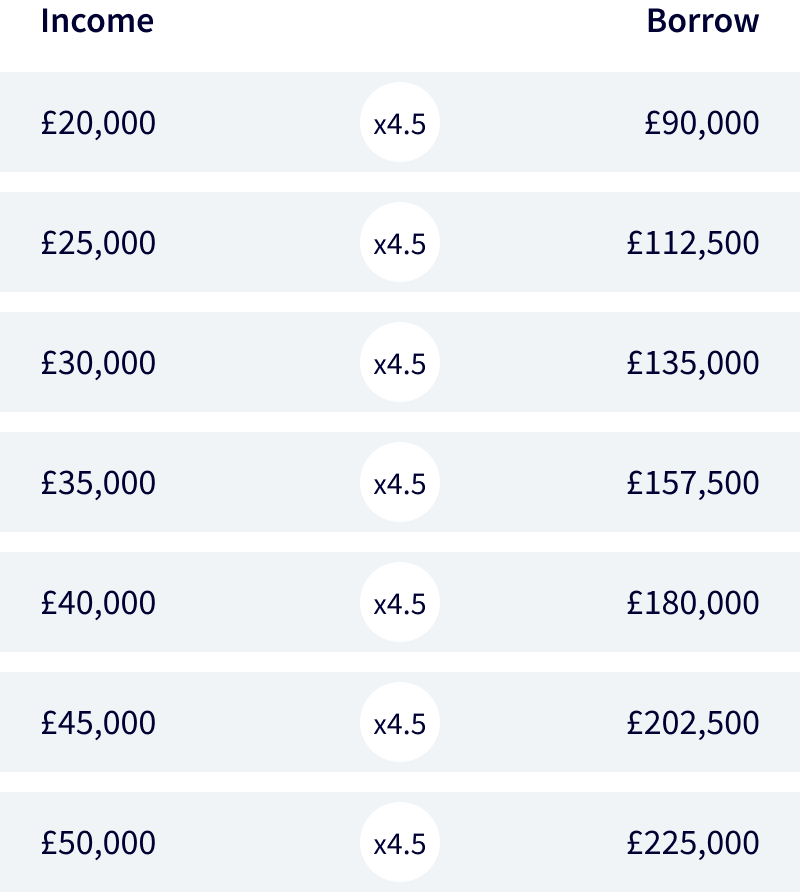

These are terms that lenders use to describe how much you might be able to borrow based on your financial situation. So a first-time borrower earning 30000 a year who could put down a 5 deposit could go looking for properties up to a maximum price ceiling of 142000. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

If youre hoping to take out a mortgage our borrowing calculator will give you a rough idea of how much a lender might offer you based on how much you earn and whether youre buying with anyone else. When it comes to home loans things that affect your borrowing power include how much you earn current debt repayments like your credit card limits or personal loans number of dependants how much youve saved as a deposit and whether you have a. Or 4 times your joint income if youre applying for a mortgage.

Stable and reliable generally includes sources such as your salary spouses salary pensionretirement part-time income and bonuses if they are reliable and anticipated to continue. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. His net salary is.

How much can I borrow. Multiply your annual salary. All they need to do is copy it onto their letterhead amend the details print sign and fax it to your mortgage broker.

Your salary will have a big impact on the amount you can borrow for a mortgage. Our mortgage calculator will give you an idea of how much you might be able to borrow. How to find the best deal for you.

Find out what you can borrow. You can use the above calculator to estimate how much you can borrow based on your salary. Most people need to borrow some amount of money in order to buy a houseand a mortgage can be part of a good investing.

So how much can you borrow. Total subsidized and unsubsidized loan limits over the course of your entire education include. Lets presume you and your spouse have a combined total annual salary of 102200.

Someone on a single income of 90000 can borrow 85000 less for a home loan than they could a year ago and a couple with a 200000 combined salary can borrow a quarter of a million dollars less. How much can I borrow. Usually banks and.

Check your bills and statements for the due date and make sure you pay on or before that. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Amount you can borrow.

Costs associated with getting a mortgage. Home buying examples. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

Convert my salary to an equivalent hourly wage. Your lender typically requires two years of W2s and current pay stubs to verify income. By monthly payment You know how much you can afford to pay each month for your mortgage.

If your salary is 54000 per year. Manage your credit and debt. While your personal savings goals or spending habits can impact your.

Mortgage insurance protects your lender and the mortgage investor if you dont make payments and default on your loan. Most lenders do not want your total debts including your mortgage to be more than 36 percent of your gross monthly income. Also you may want to see if you have one of the 50 best jobs in America.

After performing the calculation you can transfer the results to our mortgage comparison calculator where you can compare all the latest mortgage rates. You can also input your spouses income if you intend to obtain a joint application for the mortgage. Most experts recommend keeping your DTI ratio between 25 and 36.

Factors that impact affordability. We confirm the following details regarding John Smiths employment with ABC Pty Ltd. Simply put our mortgage calculator takes into consideration how much you earn and whether youre buying on your own or with someone else.

Enter your details in the calculator to estimate the maximum mortgage you can borrow. As you determine how much house you can afford remember to factor in down payments especially if youre trying to afford the 20 to avoid PMI. See you much you can afford on 100K per year.

You may also want to convert an hourly wage to a salary. Mortgage lenders used to calculate how much they would lend by a simple rule-of-thumb multiplication of an applicants income. Income that may count towards a VA loan must be stable and reliable.

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Mortgage Math Directions Chart

12 Step Guide To Getting Your Finances In Order Learn To Negotiate Salary Bills And Everything Else Personal Finance Books Money Advice Finance

The Mortgage Approval Process For Home Buying In Edmonton

How Much Money Can I Afford To Borrow For A Mortgage

Still Waiting For The Salary Just Get Yourself Rupeeredee Instant Personal Loan Pay Your Bills On Time Isn T It Simple C Personal Loans Borrow Money Loan

How Much Mortgage Can I Afford With My Income

How Much Money Can I Afford To Borrow For A Mortgage

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

How Much Personal Loan Can I Get On My Salary Personal Loans Loan Apply For A Loan

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

I Make 75 000 A Year How Much House Can I Afford Bundle

20 Personal Finance Charts To Help You Build Wealth In 2022 Banker On Fire

A Home Of Your Own Living Room Theaters Home Buying Living Room Bench

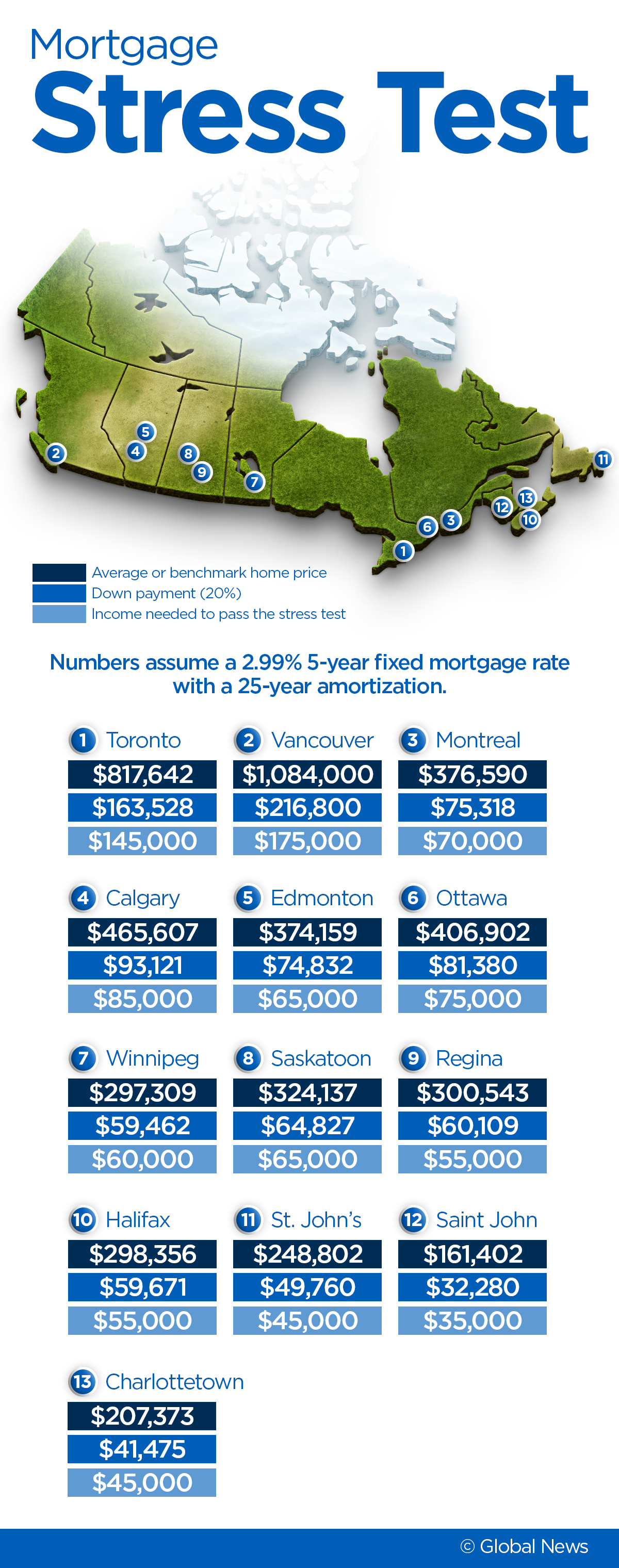

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

What Is The Income Needed For 500k Mortgage In Canada

Can You Get A Mortgage With A Part Time Job Uk Nuts About Money